Disclaimer: This article is not meant to serve as tax advice. Please consult a tax professional if you have questions.

Types of Tax Documents

One of the most frequent questions we receive from members is accessing tax documents and 1099s. You will only receive a 1099-INT from Christian Financial if your total combined interest earned from all of your accounts is more than $10. Otherwise, you will not receive a 1099-INT.

You will receive a 1099-R if you took a withdrawal from your IRA. If you have a Save to Win account, you will receive a 1099-MISC if you won more than $600 in prizes.

If you have a Home Equity Line of Credit with Christian Financial, you will receive a 1098 for Mortgage Interest paid during the year from us. Our partner, Mortgage Center, will also issue a 1098 separately.

When will Tax Documents Be Available?

Tax documents will be available online on Jan. 31. Mailed documents will be available after mail delivery, sometime in early February.

How do I know if I will receive a 1099-INT from Christian Financial?

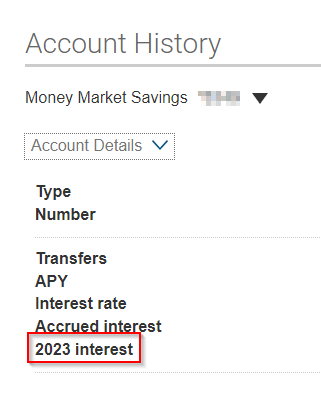

From Digital Banking – Online or Mobile Banking - navigate to your savings account. Under “Account History,” you will see “Account Details.” Expand Account Details (or “Show Details” in the Mobile App). From here you will see a field called “2023 Interest” or “Prior Year Interest” in the mobile app. If this is more than $10, you should receive a 1099-INT from Christian Financial.

If you have more than one savings account, you will need to add up the 2023 interest earned. If the total is more than $10, you will also receive a 1099-INT. You can also view your year-to-date interest earned on your E-Statements in Digital Banking.

Accessing Tax Documents

Accessing Tax Documents

If you have E-Statements with Christian Financial, you can review your tax documents in Digital Banking by logging in and selecting Statements, then My E-Statements/Notices/Tax Forms. A new window will load, and you can print them from there. These are also available in our Mobile App as well.

Member Benefits

As a Christian Financial member, you are eligible for exclusive discounts with Love My Credit Union Rewards and TurboTax. Members can save up to 20% on TurboTax federal products.

If you need a little more help, Love My Credit Union Rewards and H&R Block also offers Christian Financial members $25 in savings on in-office tax prep services for new clients and returning clients receive the Tax Identity Shield add-on for FREE ($35 value).

Tax Time can be overwhelming, but Christian Financial’s digital resources can help answer your questions and help you feel prepared to tackle your taxes.