Welcome to Christian Financial

Merger Center

We’re excited to bring you updates about the merger between CVF and CFCU! Get the key dates, take a look at your new Digital Banking experience, and see what great benefits are coming your way.

Merger Center Digital Banking Log In Information

How do I log in to CFCU Digital Banking for the first time?

CVF members can begin logging into CFCU’s Digital Banking starting Monday, November 3. Click the Log In button in the upper right corner, and enter your current username along with your temporary password. Learn how to log in with this tutorial.

How do I log in to CFCU Business Digital Banking for the first time?

CVF members can begin logging into CFCU’s Business Digital Banking starting Monday, November 3. Click the Log In button in the upper right corner, and enter your current username along with your temporary password. Learn how to log in with this tutorial.

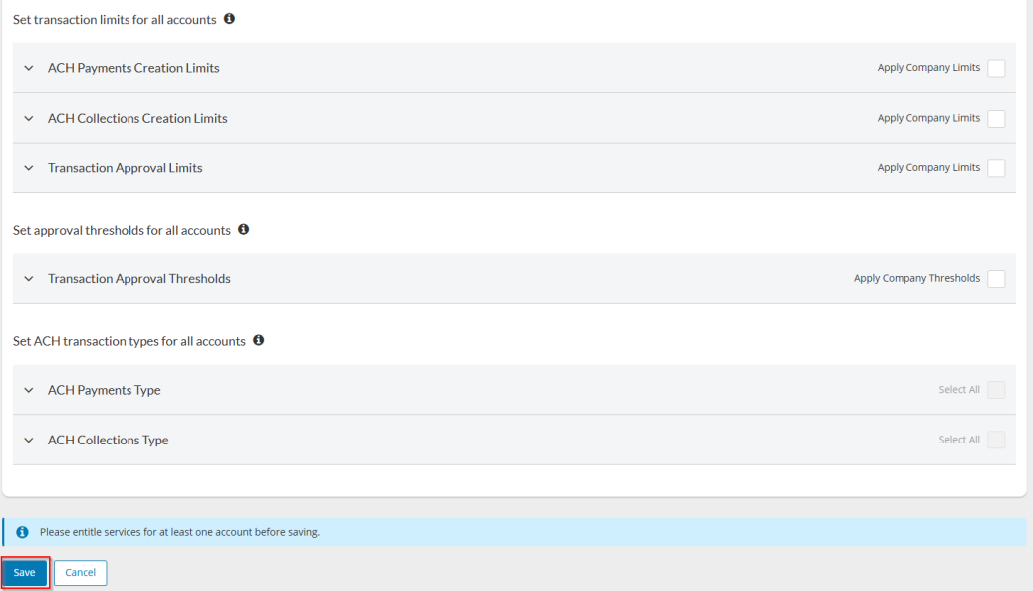

Adding a Business User to Online Banking

Only Primary Admins can add Business Users to their online banking. Also, Business Users do not have to be signers on an account to have online banking access.

-

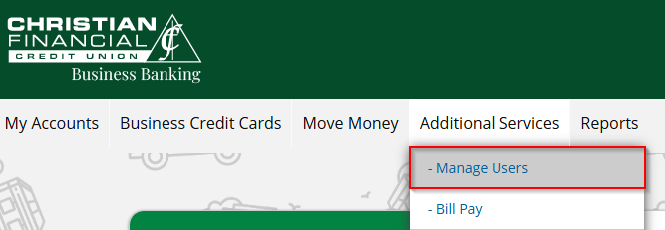

Once the Primary Admin is logged into business online banking, navigate to Additional Services and select Manage Users.

-

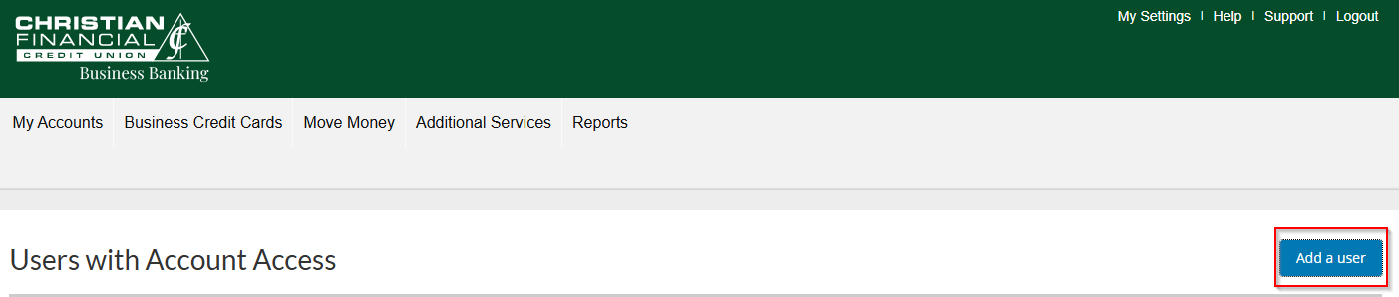

Click Add a user to add a new Business User.

-

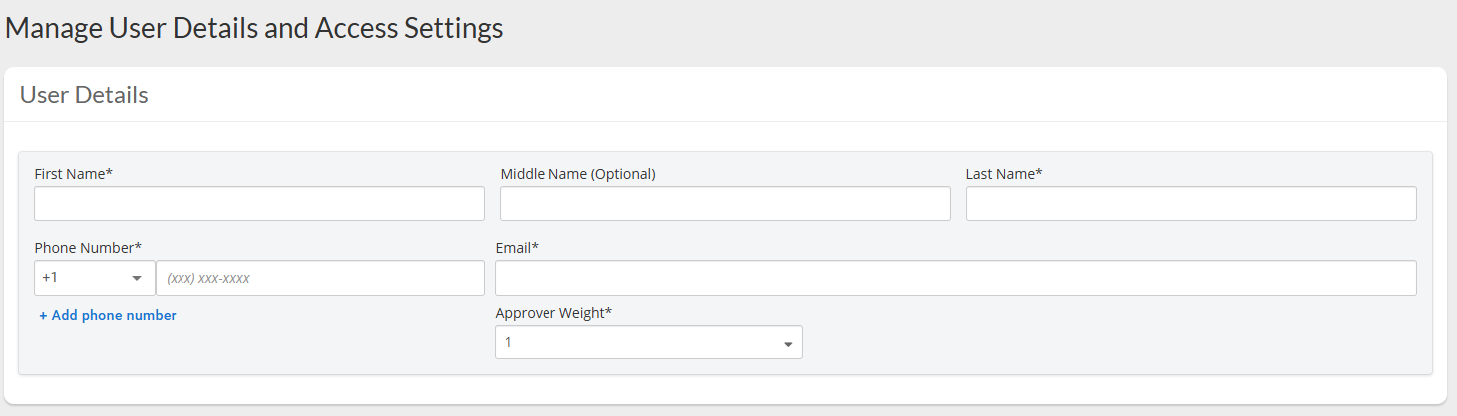

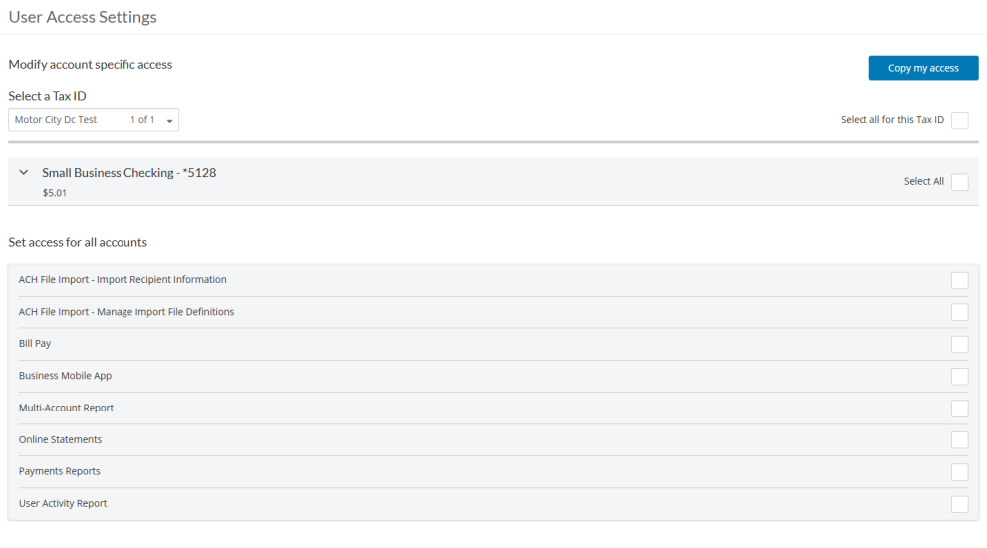

The Primary Admin will complete the User Details fields with the individual’s information and the User Access Settings fields, with the individual’s account permissions.

-

Once completed, select Save at the bottom of the screen.

-

Next, the Business User will receive two emails, one with a temporary username and one with the password. The temporary username doesn’t expire, but the temporary password is only valid for 30 minutes. It is advised the Primary Admin notify the Business User immediately to complete the online banking registration.

Updating Quicken to CFCU Account

- Open Quicken and go to the Dashboard.

- Click "+ Add Account" or "+ New".

- Enter your Christian Financial login credentials.

- When Quicken displays the accounts it found, look for the “Action” column next to each account.

- In the Action dropdown, choose “Link to existing account” instead of “Add as New”.

– This connects the new bank feed to your current Quicken account.

– Avoid “Add as New” to prevent duplicate accounts and split history. - Verify that the correct account is linked by checking the name, type, and balance.

- Complete the connection and sync.

Your Digital Branch

Merger Center Important Dates

Mark Your Calendar

Conversion Times & Availability | 10.31

All of our branch locations, Online Banking/ mobile app and the Member Solutions Center will be unavailable from Friday, October 31 at 5:00 pm through Sunday, November 2. We will re-open on November 3 for regular business hours.

Services Restored | 11.3

Branches, Online/Mobile Banking and the Member Solutions Center will be available at 9:00 am on Monday, November 3. CVF members can log in to Digital Banking for the first time.

Debit Card Activation | 11.3

CVF Debit Card users can activate their new CFCU Debit Card, and begin updating payments with their new card information.

Available Services

- Credit Cards - CVF Members should have already received and activated their CFCU credit card.

- Debit Cards - CVF Members Only

- CVF Debit Card: Expire Nov. 2

- New CFCU Debit Card: Begin Activating Nov. 3

- ATMs

- CO-OP

- Non-CFCU ATMs

- Virtual Assistant - Our Virtual Assistant is available for general questions.

Unavailable Services

Branches and Member Solutions Contact Center will be Closed Saturday, Nov. 1

- Shared Branching

- Online Banking

- Mobile App

- Virtual Assistant - Our Virtual Assistant will be unavailable for Account-Related Questions.

Additional Merger Information

It's All In The Cards

Here’s where you will get all the information you need about your Debit Card during the merger.

Attention Scorecard Rewards Users: To view your points, access the portal from inside online banking. Then, navigate to Card Services or click here.

You Need to Know

Important Information about Statements

All former CVF Credit Union members will receive a paper statement for October 2025. Additionally, there will be a brief interruption in eStatement availability during our transition, which means eStatements will not be available in your new CFCU Digital Banking system until Nov. 15. If you need eStatements during this time, please download in advance by October 31, 2025.

Check out our merger guide below for all the information you need for a smooth transition to CFCU's system this October. You can even print or download the book for your reference later!

Merger Guide

Want to Chat?

We're here anytime you need us.